Legislators will be back in Juneau for another special session starting July 11, to wrestle anew with key proposals aimed at working the state out of a long-term budget crisis brought on by low oil prices.

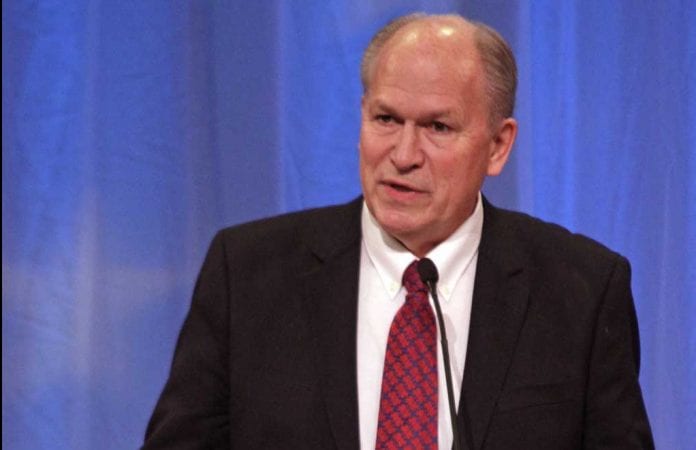

Gov. Bill Walker announced the second special session on June 19, after expressing his disappointment that Senate Bill 128 never made it to the House floor for a vote.

“We can’t afford not to have another special session to resolve this issue,” he said.

“The Permanent Fund is at risk. If we don’t do something now it will be at zero in four years. We can’t blame our way out of the deficit.”

“With a $4 billion deficit, it is time we pull together as Alaskans to address this fiscal deficit now,” Walker said, thanking the Senate for its passage of SB 128.

SB 128 would restructure the Alaska Permanent Fund to help pay for operating state government by putting a $1,000 cap on the state’s Permanent Fund Dividend checks. After passing in the Senate, the measure was blocked in the House.

The House adjourned on June 19, the 28th day of the fourth special session of the 29th Legislature, a two-year-term.

After three special sessions in 2015, legislators were unable to come to a majority agreement on any version SB 128, to restructure the Alaska Permanent Fund.

“This Legislature has proved incapable of addressing the deficit with any new tax,” noted Rep. Paul Seaton, R-Homer, in a letter to constituents after the session ended.

None of the tax measures introduced by Walker this year could pass the House and most were never even considered by the Senate, he said.

Now proposed measures to introduce or raise taxes on motor fuels, commercial fishing, the most profitable mines, cigarettes, alcoholic drinks, and oil, plus a state income tax equal to 6 percent of the federal tax will be back on the table, along with a sales tax. Also back on the table will be sections of oil and gas taxes and credits that were not improved sufficiently in HB 247, the last oil bill, Seaton said.

“I would be very worried if the governor did not have the tool of the line item veto where he can simply veto the $430 million in HB 247 extra oil and gas tax credits and whatever amount he determines is needed to reduce the PFD,” Seaton said.

HB 247, which passed the Legislature, did not include the percentage increase in oil production taxes that Walker had sought.

Seaton himself had introduced HB 365, which he said is the most fair and balanced solution to addressing both restructuring and preserving the PFD and new revenue.

A state income tax would mean that those working in Alaska but living elsewhere would be taxed on income they earn in the state.

Rep. Bryce Edgmon, D-Dillingham, told his constituents that there was nothing he likes about bills to restructure the Permanent Fund, raise additional revenues from a wide range of sources and reform “our unsustainably generous tax credits for the oil and gas industry, HB 247.”

Many people, himself included, felt that HB 247, which did pass during the last special session, did not go far enough in requiring the North Slope producers to contribute to a solution to the state’s fiscal crisis, Edgmon said.

“But the reason Governor Walker has called us back again is simple: If we don’t get a fiscal plan in place as soon as possible, the state will run out of Constitutional Budget Reserve savings in just a couple of years, and everyone will be much worse off,” he said.

Rep. Louise Stutes, R-Kodiak, and Sen. Gary Stevens-R-Kodiak, who represent the Cordova area in the Legislature, also agreed the state is in a tough spot fiscally.

“It’s a tough situation for sure,” said Stutes.

“My priority is the health of the state and doing what’s right for everybody.

You can’t just go through with a machete and cut all these departments without knowing how it will affect them. You have to do it in a smart way, and everyone has to have some skin in the game,” said Stutes, who balked at raising commercial fishing taxes while oil companies kept their tax advantages.

Until recently HB 247 addressed some of the Cook Inlet oil industry, but it didn’t address the North Slope, she said. “Prior to 247, there wasn’t any place in the world that the oil companies had a better deal than in Alaska. It just has to stop. We can’t afford to do that.

“We had a good HB 247. Then when it came back to the House it had a $430 million fiscal note… I can’t vote for a PFD decrease and income tax as long as we are giving those kinds of taxes to oil companies. People are willing to participate, but not willing to give our (PFD) checks to the oil companies,” she said.

The governor has the ability to redline the $430 million (fiscal note in HB 247), she said. “That would be a start. I hope he does. I think the governor really wants to do what’s right for the state.”

As for cutting state government, she said “you don’t go in with a machete; you go in with a scalpel. There are certain services we are required to provide and you want to provide them in a fair and equitable manner.”

Stevens said he was disappointed that the House did not move ahead on any use of the PFD.

“The idea of capping the dividend at $1,000 is anathema,” Stevens said, “but we are in a very tough spot. If we do nothing in five years our savings will be gone and we will have to dip into the earnings reserve of the Permanent Fund.

As for the current oil tax structure, Stevens said that’s something he has said he wants to do away with.

“We are giving away too much to the oil companies.

“We will have to find some compromise,” he said.